In order to discuss the above mentioned topics and to answer to a research question requiring to illustrate the benefits of energy derivatives and risk management for the companies operating in the energy sector this thesis follows a logical process spread out five chapters. Read honest and unbiased product reviews from our users.

Energy Derivatives Pricing And Risk Management Les

Energy Derivatives Pricing And Risk Management Les

The recent availability of high frequency data allows for refined methods in.

Energy Derivatives Pricing And Risk Management Free Download Read Online. Measuring and modeling financial volatility is the key to derivative pricing asset allocation and risk management. He has been a faculty member of mennta energy solutions since 2004 where he teaches the derivatives pricing hedging and risk management certificate programme as well as courses on counterparty risk management and gas and power trading and risk. This has enabled the valuation and risk management.

Pricing risk management. Les clewlow chris strickland with contributions from vince kaminiski grant masson and ronnie chahal this book available in pdf form only provides a comprehensive and technical treatment of the valuation and risk management of energy derivatives within the oil gas and electricity markets. Pricing and risk management this intermediate course is aimed at the energy professional who is familiar with energy derivative products but who requires an understanding of the pricing and risk management of energy derivatives.

Free shipping on qualifying offers. Dr carlos blanco is an expert in energy commodity and financial risk management and modeling. An integrated risk management system within the enterprise.

Risk neutral pricing and stochastic models developed for financial derivatives have been extended to energy derivatives for the modeling of correlated commodity and shipping forward curves and for the pricing of their contingent claims. Find helpful customer reviews and review ratings for energy derivatives. Energy price processes used for derivatives pricing risk management in this first of three articles we will describe the most commonly used process geometric brownian motion.

Energy Derivatives Pricing And Risk Management Les Clewlow

Energy Derivatives Pricing And Risk Management Les Clewlow

Energy Derivatives And Risk Management

Energy Derivatives And Risk Management

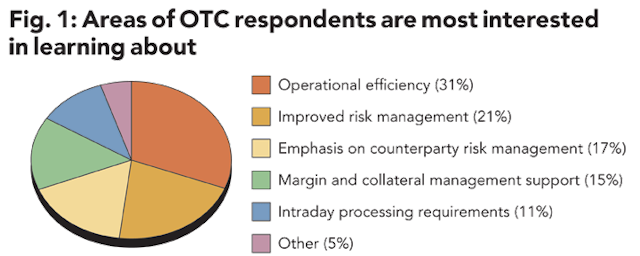

Survey Results 70 Plan To Automate Otc Derivatives Post

Survey Results 70 Plan To Automate Otc Derivatives Post

Hedging And Risk Management Renesource Capital

Hedging And Risk Management Renesource Capital

Pdf Download Energy Derivatives Pricing And Risk

An Introduction To Fuel Hedging

An Introduction To Fuel Hedging

Untitled

Energy Price Processes Used For Derivatives Pricing Risk

Energy Price Processes Used For Derivatives Pricing Risk

Commodity Risk Management Aspectctrm

Commodity Risk Management Aspectctrm

Energy Markets Risk Management Optimal Liquidation And

Energy Markets Risk Management Optimal Liquidation And

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg) Amazoncom Energy Risk Valuing And Managing Energy

Amazoncom Energy Risk Valuing And Managing Energy

Energy Derivatives Pricing And Risk Management Chris

Energy Derivatives Pricing And Risk Management Chris

Table I From Risk Management And Firm Value Evidence From

Table I From Risk Management And Firm Value Evidence From

Studyguide For Energy Risk Valuing And Managing Energy Derivatives By Pilipovic Dragana Isbn 9780071485944

Studyguide For Energy Risk Valuing And Managing Energy Derivatives By Pilipovic Dragana Isbn 9780071485944

Ch 1

Ch 1